A survey of 100 HR Managers was recently conducted. It was discovered that when considering various options for health insurance financial platforms, HR Managers are most familiar with fully-insured or self-funded health financial platforms.

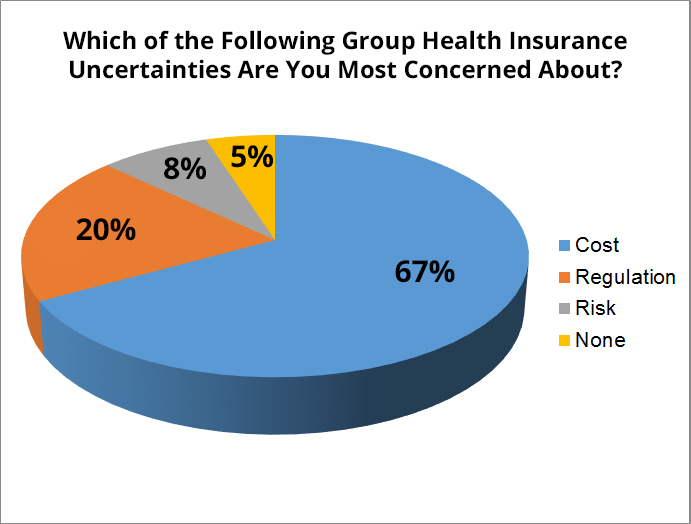

Many HR managers reported that these varying platforms were very important to their needs and interests. They also reported being most concerned about the cost when it comes to the potential challenges surrounding the implementation of group health insurance financial platforms.

But what exactly is a health insurance financial platform?

- Group health insurance is a policy that is purchased by an employer and then offered to the eligible employees.

- Many employees have group health insurance benefits either via their employer or via their spouse’s employer’s group health insurance.

- Many group health insurance policies are uniform and don’t vary from person to person within the company, though there is room for customization.

The least-known platform is called a “Professional Services Organization”. This health insurance platform means that the employer contracts out services such as payroll, human resources, employee benefits, and tax compliance regulations.

The current health insurance landscape gives many HR Managers greatest cause for concern. Changes to health insurance laws could directly affect costs and employee benefits packages.

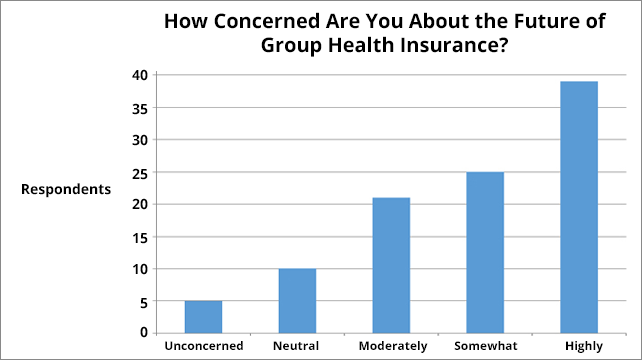

As discovered from the survey results, most HR Managers stated that they were “moderately” or “highly” concerned about the future of group health insurance. An understanding of group health insurance, and most importantly the costs of same, are vital when it comes to forecasting group health insurance plans and policies for employees.

WNC Health Insurance helps HR Managers make better decisions about how to move forward with health insurance plans for their employees. Contact us today!